What is Safe Keeping Receipt (SKR) Fraud?

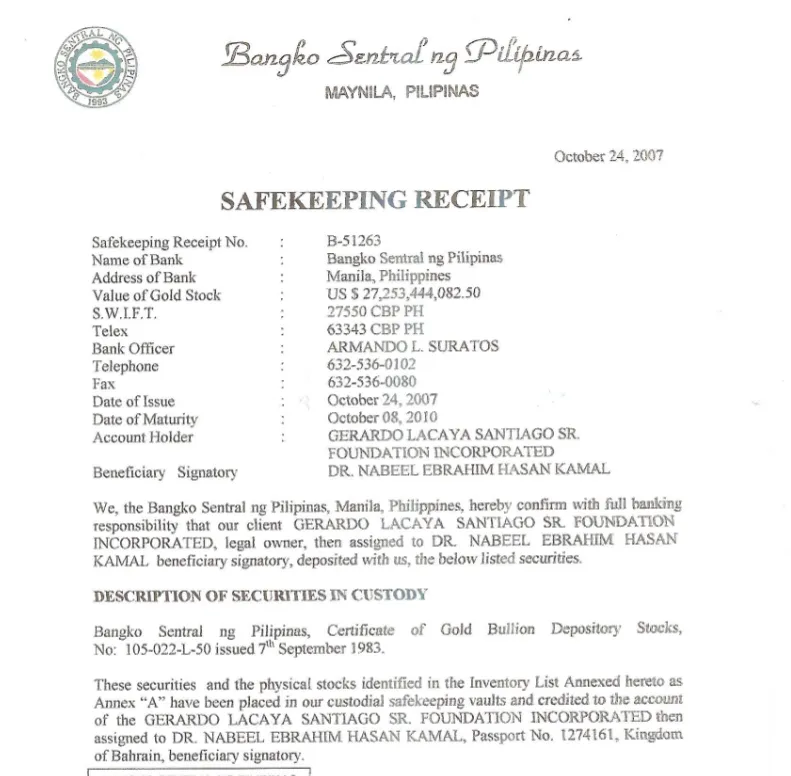

Safe Keeping Receipt (SKR) fraud is a type of financial scam that targets investors and individuals involved in high-value transactions. A Safe Keeping Receipt (SKR) is a document issued by a financial institution or bank, confirming that certain assets (such as cash, gold, securities, or valuable items) are securely held. However, fraudsters create fake or invalid SKRs to deceive victims and extract money from them.

How the Scam Works:

Fake SKR Documents – Scammers produce fraudulent SKR documents that appear to be issued by legitimate banks or financial institutions.

Deceiving Investors – They claim that the SKR represents valuable assets and persuade victims to invest in fraudulent schemes.

Accessing Loans and Funds – Fraudsters may use fake SKRs as collateral to secure loans or attract unsuspecting investors.

Advance Fee Fraud – Scammers often demand upfront fees for unlocking or monetizing the SKR, then disappear after receiving the payment.

How to Protect Yourself:

Verify Financial Institutions – Always check with the issuing bank or institution to confirm the legitimacy of an SKR.

Seek Independent Verification – Consult financial experts or legal advisors to authenticate any SKR before making transactions.

Be Cautious of Upfront Fees – Avoid any deal that requires advance payments for unlocking funds or high returns.

Report Suspicious Activities – If you suspect SKR fraud, report it to financial authorities and law enforcement agencies.

Since SKR fraud often involves large sums of money, due diligence is crucial to avoid financial losses.

Safe Keeping Receipt (SKR) fraud is a type of financial scam that targets investors and individuals involved in high-value transactions. A Safe Keeping Receipt (SKR) is a document issued by a financial institution or bank, confirming that certain assets (such as cash, gold, securities, or valuable items) are securely held. However, fraudsters create fake or invalid SKRs to deceive victims and extract money from them.

How the Scam Works:

Fake SKR Documents – Scammers produce fraudulent SKR documents that appear to be issued by legitimate banks or financial institutions.

Deceiving Investors – They claim that the SKR represents valuable assets and persuade victims to invest in fraudulent schemes.

Accessing Loans and Funds – Fraudsters may use fake SKRs as collateral to secure loans or attract unsuspecting investors.

Advance Fee Fraud – Scammers often demand upfront fees for unlocking or monetizing the SKR, then disappear after receiving the payment.

How to Protect Yourself:

Verify Financial Institutions – Always check with the issuing bank or institution to confirm the legitimacy of an SKR.

Seek Independent Verification – Consult financial experts or legal advisors to authenticate any SKR before making transactions.

Be Cautious of Upfront Fees – Avoid any deal that requires advance payments for unlocking funds or high returns.

Report Suspicious Activities – If you suspect SKR fraud, report it to financial authorities and law enforcement agencies.

Since SKR fraud often involves large sums of money, due diligence is crucial to avoid financial losses.